On 29 March 2022 the previous government announced a digital adoption boost (see below if you want to know what it is)… it was to run from 30 March 2022 for 15 months and end on 30 June 2023.

I was asked to give advice on it on 30 March 2022 and I said that until I see the final law it is pretty hard to give final advice.

Change in government and a confirmation they will continue with this proposal.

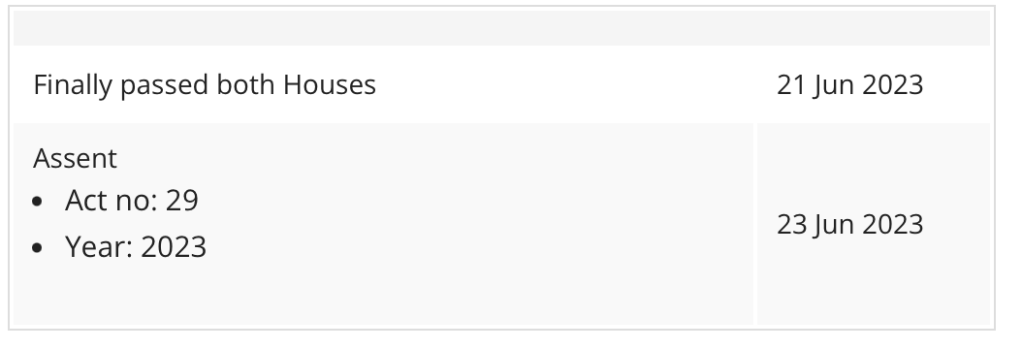

So when do we get the final law??? on 23 June 2023, a mere 7 days before the digital adoption boost ends, the GG signs the Bill into law. Anyone need advice in the one week I can actually give final advice???

Digital Adoption Boost… A summary…

Small businesses (aggregated annual turnover of less than $50 million) who incur certain expenditure (including on depreciable assets) between 30 March 2022 and 30 June 2023 (inclusive) get an additional deduction of 20%. The expenditure must be for the purposes of their digital operations or digitising their operations and can include expenditure on computer and telecommunications hardware and equipment, software, internet costs, computer networks, digital media and marketing, web design, e-commerce products like portable payment devices, subscriptions to cloud-based services, and cyber security systems.

BUT REMEMBER… this additional deduction only applies for expenditure of up to $100,000, up to a maximum bonus deduction of $20,000.

Leave a comment